Financial markets around the world spiraled downward last week.

As I write this post, the S&P 500 (the 500 largest stocks in the United States, by market capitalization) is approximately 10% lower than the all-time high it reached earlier this year.

So, what’s an investor to do?

Is it time to get out of stocks and avoid the financial markets, once and for all?

Obviously, everyone’s situation is different, but for most folks the answer is no, I don’t think so.

And in this post, I’ll explain why.

Using a few slides put together by our friends at Dimensional Fund Advisors, we’ll talk about why most investors fail to gain their fair share of market rate returns and why it’s important to maintain discipline, especially in the midst of a market panic similar to what we’re experiencing now.

We’re not wired for disciplined investing

One of the hurdles we face as investors is that we’re not naturally wired for the long-term discipline required for successful investing.

The photo below gives us several examples of how we talk ourselves into (or out of) different investment decisions.

When making investment decisions, we tend to rely on our natural instincts, which more often than not, cause us to apply faulty reasoning to the decision-making process.

Most investors follow their emotions

This faulty reasoning pushes us to make investment decisions based on emotions, such as fear and greed, when instead, we should be relying on wisdom and facts.

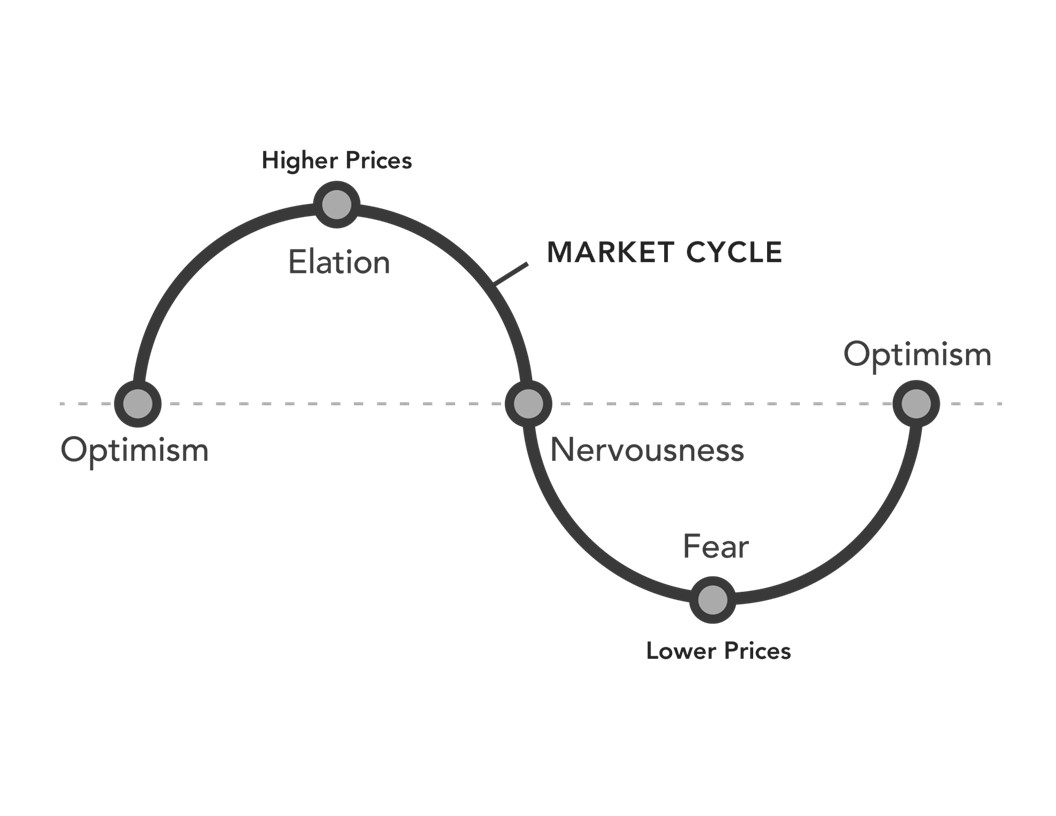

The photo above is a perfect example of what happens to many investors during a typical market cycle.

As prices begin to rise, investors get excited, optimistic, and even greedy at times. This greed causes them to buy more and more of a particular investment when prices are at their highest levels.

As prices begin to go down, investors get nervous and fearful, causing them to sell more and more of a particular investment when prices are at their lowest levels.

While the goal of investing is to buy low and sell high, unfortunately most investors, controlled by emotions such as fear and greed, end up doing the exact opposite!

Reacting can hurt performance

When you let your emotions, such as fear and greed, influence your investing decisions, you tend to jump in and out of the financial markets based on what the news headlines are saying at any given moment.

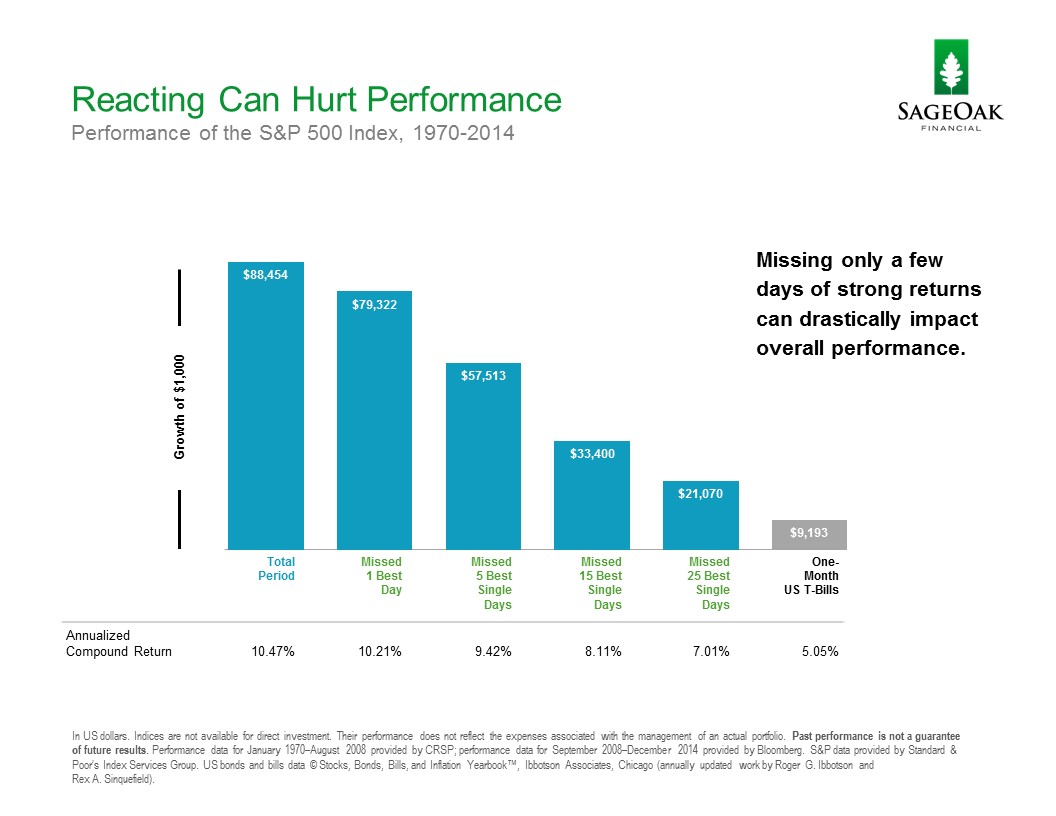

These attempts to “time the market” can severely hinder your long-term performance.

If you don’t believe me, just take a look at the chart/photo below…

As you can see, historically, missing the single best day of the S&P 500’s returns would have caused you to decrease your overall return by a substantial margin.

And it only goes downhill from there.

The more days you missed, the more it would have negatively impacted your overall return.

Historically, markets have rewarded discipline

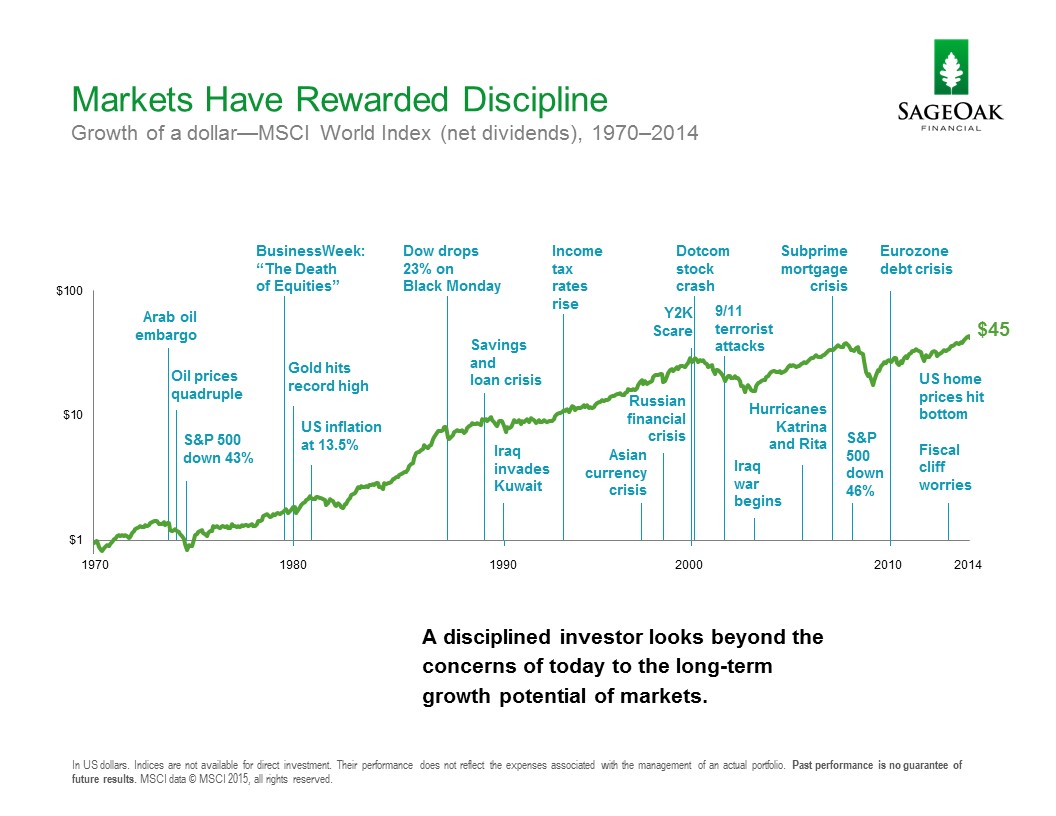

Rather than rely on our emotions to determine investing decisions, I prefer to help clients reach their goals using evidence taken from the field of financial science, along with timeless financial wisdom and principles.

For example, even with all of the financial crises over the last 40+ years, the chart below illustrates how the global financial markets, as measured by the MSCI World Index (net dividends), have rewarded long-term discipline.

This illustrates the importance of developing a long-term, globally diversified investment plan that is customized to your goals, risk tolerance, time horizon, values, etc.

This doesn’t mean you can “set it and forget it,” but it certainly means you won’t be tossed to and fro during the investing storms that inevitability pop up from time to time.

And you certainly won’t make decisions about your investments because of what some guy on TV said you should do!

Focus on what you can control

Since no one can reliably predict or forecast short-term movements in the financial markets, investors should focus on the things they CAN control.

These things include, but aren’t limited to…

- Expenses

- Taxes

- Turnover

- Asset allocation

- Risk level

- Savings rates

- Withdrawal rates

Even these things can be intimidating for most folks though. The good news is that you don’t have to do this alone!

If you’re tired of worrying about the ups and downs of the financial markets, then maybe it’s time you experience the peace and tranquility of having a trusted advisor walk alongside you during the middle of a financial storm.

If you hire the right financial advisor, they’ll help free up your time and energy so you can focus on what’s most important to you, such as faith, family, and friends.

And rest assured, if you’re anything like my clients, you’ll be glad you did!

Check out this recent blog post for a few tips on how to find a good financial advisor.