In our last post, I talked about why your investment philosophy matters as well as the sequence of events that typically result from adhering to a poor investment philosophy.

This week, we’re going talk about what a good investment philosophy looks like, as well as how to spot a bad investment philosophy.

Hint: Most investors and financial professionals have a poor investment philosophy.

To recap, your investment philosophy is like a map or the GPS system in your car that you follow on a summer road trip. It guides you on your investing journey. And just like a map, if it’s a good one, it will help get you where you want to go safely and efficiently.

On the other hand, if it’s a bad one, it might leave you stranded in a ditch on the side of the road or worse, headed the wrong direction down a one-way street.

In other words, while a good investment philosophy doesn’t guarantee investing success, it certainly provides a good foundation.

What does a good investment philosophy look like?

Below is a short list comparing three key differences between a good investment philosophy and a poor investment philosophy.

Good Investment Philosophy

1. Based on facts

2. Based on timeless principles

3. Based on wisdom

Poor Investment Philosophy

1. Based on feelings

2. Based on temporary trends

3. Based on worry and fear

These are some of the main principles that drive your investment decisions, which can impact the amount of risk you take, and will increase (or decrease) your stress level in relation to your investments.

Let’s take a look at each one individually and see how they impact your chances of achieving investing success.

A. Facts vs. feelings

How many times have you heard (or thought!) the following…

“I’ve got a good feeling about this stock.”

“The trend looks good and I think it’ll continue for a while.”

“This fund has a great track record, so it seems like a good pick to me.”

The problem with these statements and many others like them is that they aren’t based on anything but your “gut” feelings.

If you’re right, then maybe your investments will do well.

But what if that gut feeling was just…indigestion?

Well, now you’re in trouble!

A better approach is to base your investment decisions on facts backed up by years of academic research. This is known as evidence-based investing.

Evidence-based investing is just a fancy term that means instead of relying solely on your “gut” when making investment decisions, you’re considering what years of research in the field of financial science has to say about the world of investing.

For example, research has shown that there are several factors that influence an equity (stock) investor’s expected rate of return, including the following:

1. Market

Stocks have higher expected returns than bonds.

2. Size

Small capitalization stocks have higher expected returns than large capitalization stocks.

3. Price

“Value” stocks have higher expected returns than “growth” stocks.

(“Profitability” is another recently discovered factor that influences an equity investor’s expected rate of return, but the research is still pouring in on that one, so I’ll leave that factor for another day.)

Don’t take my word for it though.

Take a look at the evidence for yourself:

(Click here to enlarge)

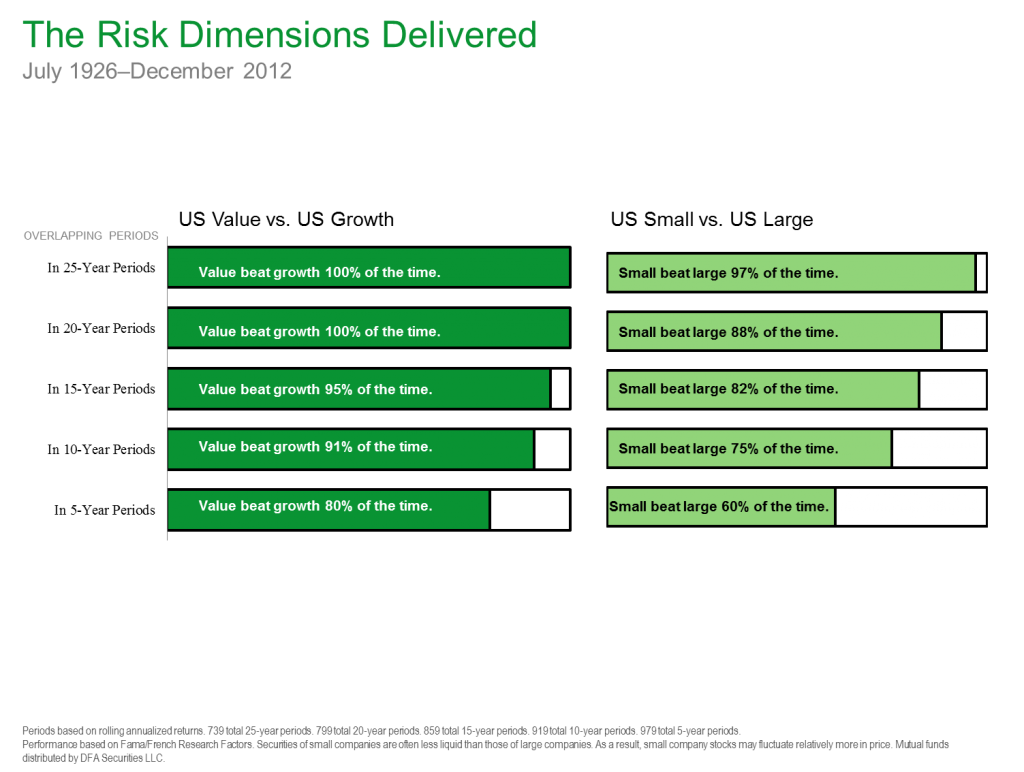

Above is a chart illustrating how two of the equity factors described above played out in the United States from July 1926 through December 2012.

This doesn’t mean you should only invest in small cap and value stocks and it doesn’t mean that this trend is guaranteed to continue in the future, but it does indicate that in the past, over long periods of time, small cap and value stocks seemed to experience a higher expected return than large cap and growth stocks.

If we believe this trend will continue in the future, we might want to consider slightly over-weighting our equity portfolio a little more in the direction of small cap and value stocks in comparison to the overall market.

That’s the heart of evidence-based investing…taking research findings in the field of financial science and implementing them into your portfolio.

You wouldn’t get a medical opinion based on someone’s “gut” feelings, so why do you make investment decisions based on them?

B. Timeless vs. temporary

Most of what you read about in the financial press is geared towards pushing you to make quick decisions. It isn’t usually geared towards the long-term, disciplined investing approach that is required in order to garner your fair share of market returns.

Rather than rely on temporary trends, a good investment philosophy will be timeless.

For an example, take a look at the chart below:

(Click here to enlarge)

This chart shows that the same two factors in the previous chart describing the U.S. market have also proven true in international markets over the past 30+ years.

As you can see, a good investment philosophy will transcend temporary fads and should prove true time and again in various markets around the world.

It’s no guarantee of positive returns, but it’s better than the alternative option (remember the indigestion?).

C. Wisdom vs. worry and fear

This is a big one.

Do you ever get anxious thinking about your retirement account or your children’s college funds?

Do you sometimes worry about whether or not you’ll have “enough” or whether you’ll outlive your money?

Do news events such as wars, natural disasters, and changes in the political climate cause you to worry about whether or not you’re invested properly?

If you answered “yes” to any of those questions, then your investment philosophy is based on worry and fear instead of wisdom and truth.

People who invest with wisdom know that money is just a tool and that we’re just stewards of the resources God has entrusted us with during our short time here on Earth.

They know that worrying, especially worrying about things they can’t control, is an exercise in futility.

Look at the birds of the air: they neither sow nor reap nor gather into barns, and yet your heavenly Father feeds them. Are you not of more value than they? And which of you by being anxious can add a single hour to his span of life?

Matthew 6:26-27 (ESV)

Instead, they focus on things they CAN control such as…

- Diversification

- Asset allocation

- Tax minimization

- Minimizing investment costs

- Proper location of assets

- Savings and withdrawal rates

- And more!

They also know that with a good investment philosophy, short-term movements in the markets are just distractions and that their REAL focus should be on whether or not they are making progress towards reaching their long-term goals.

Since investment philosophies aren’t developed overnight, they shouldn’t change overnight either.

Stop worrying and start investing wisely.

A lesson from “The Gambler”

As you can hopefully see from this post and the previous one, every investor has an investment philosophy that drives their investment decisions. And the unfortunate truth for most investors is that their current philosophy isn’t a very good one.

So, what’s an investor with a poor investment philosophy to do in this situation?

The great “investment guru,” Kenny Rogers, said it like this in his 1978 hit song, “The Gambler”…

You’ve got to know when to hold ’em

Know when to fold ’em

Know when to walk away

Know when to run

Although I don’t typically advocate people get their investment advice from a song about poker, the gambler’s tip about knowing when to walk away and knowing when to run are certainly applicable here.

If it seems like your investment philosophy isn’t quite up to par, this would be the time to walk away (or run!) and talk to someone who can help you in formulating a better one.

Click here to schedule a complimentary 15-30 minute phone call about your investment philosophy